Page 30 - issue 21

P. 30

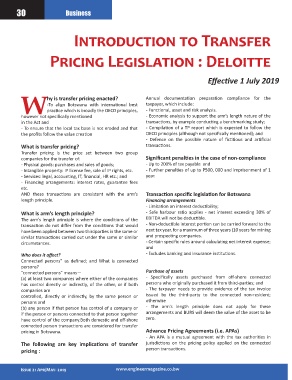

30 Business

Introduction to Transfer

Pricing Legislation : Deloitte

Effective 1 July 2019

W hy is transfer pricing enacted? Annual documentation preparation compliance for the

taxpayer, which include:

-To align Botswana with international best

practice which is broadly the OECD principles,

- Economic analysis to support the arm’s length nature of the

however not specifically mentioned - Functional, asset and risk analysis.

in the Act and transactions, by example conducting a benchmarking study;

- To ensure that the local tax base is not eroded and that - Compilation of a TP report which is expected to follow the

the profits follow the value creation OECD principles (although not specifically mentioned); and

- Defence on the possible nature of fictitious and artificial

What is transfer pricing? transactions.

Transfer pricing is the price set between two group

companies for the transfer of: Significant penalties in the case of non-compliance

- Physical goods: purchases and sales of goods; - Up to 200% of tax payable and

- Intangible property: IP license fee, sale of IP rights, etc. - Further penalties of up to P500, 000 and imprisonment of 1

- Services: legal, accounting, IT, financial, HR etc.; and year.

- Financing arrangements: interest rates, guarantee fees

etc.

AND these transactions are consistent with the arm’s Transaction specific legislation for Botswana

length principle. Financing arrangements

- Limitation on interest deductibility;

What is arm’s length principle? - Safe harbour ratio applies - net interest exceeding 30% of

The arm’s length principle is where the conditions of the EBITDA will not be deductible.

transaction do not differ from the conditions that would - Non-deductible interest portion can be carried forward to the

have been applied between two thirdparties in the same or next tax year, for a maximum of three years (10 years for mining

similar transactions carried out under the same or similar and prospecting companies.

circumstances. - Certain specific rules around calculating net interest expense;

and

Who does it affect? - Excludes banking and insurance institutions.

Connected persons” as defined; and What is connected

persons?

“connected persons” means— Purchase of assets

(a) at least two companies where either of the companies - Specifically assets purchased from off-shore connected

has control directly or indirectly, of the other, or if both persons who originally purchased it from third-parties; and

companies are - The taxpayer needs to provide evidence of the tax invoice

controlled, directly or indirectly, by the same person or issued by the third-party to the connected non-resident;

persons and otherwise

(b) any person if that person has control of a company or - The arm’s length principle does not apply for these

if the person or persons connected to that person together arrangements and BURS will deem the value of the asset to be

have control of the company.Both domestic and off-shore zero.

connected person transactions are considered for transfer

pricing in Botswana. Advance Pricing Agreements (i.e. APAs)

- An APA is a mutual agreement with the tax authorities in

The following are key implications of transfer jurisdictions on the pricing policy applied on the connected

pricing : person transactions.

Issue 21 Apr/May- 2019 www.engineermagazine.co.bw www.engineermagazine.co.bw Issue 21 Apr/May - 2019